Free Money for College – Grants and Scholarships

By Joe Messinger, CFP®

November 10, 2023

In today’s college search, students put so much stress on themselves to find the right “fit.” Often, they focus on schools where they can get in and get a great education. In other words, finding a good academic and social fit. However, with the rising cost of education, finding a good financial fit must be a part of this equation in the 21st century. Understanding the financial fit includes understanding the sources of what we call “free money.” Free money is funding that the student will not have to pay back and includes grants and scholarships.

In general terms, the money to pay for college comes from a few different buckets–from the government, the college, private entities, loans, and, of course, from your pocket. Loans, work-study, and a family’s savings are not “free,” so let’s dig into free!

So where can you find “free money”?

- Need-Based Aid

- Government Grants

- Institutional Grants and Scholarships

- Private Grants and Scholarships

A family’s financial situation determines if they qualify for need-based aid. A student’s academic prowess determines if they qualify for merit scholarships.

Need-Based Aid

The government has set formulas to determine how much a family can “afford” to pay their Expected Family Contribution or EFC. I put “afford” in quotes because when you see that number, you may laugh at the thought that this large figure is what you should be able to afford from your income and assets! The student may be eligible for need-based aid for families with a low EFC. The EFC is determined by filling out the Free Application for Federal Student Aid (FAFSA). You can get an estimate of your EFC with this calculator.

Need-based aid is awarded in two ways:

- Gift Aid – Does not need to be paid back, so is a form of “free money”

- Self Help – Either a loan that you must repay in the future or a “work-study”

Self-help listed above is not free money. A loan will need to be repaid over time, and work-study requires effort and time by the student.

A Note for the Class of 2024

If your student is a proud member of the Class of 2024, you know that the FAFSA opens in December of this year instead of its usual October 1st date. While this may be frustrating for families who want to get ahead and better understand what type of aid they’ll receive ASAP, it’s important to stay the course and file your application in a timely manner once it opens.

It’s also helpful to remember that scholarships coming from the schools you apply to will likely come with your admissions letter, and you can always pursue private scholarships and grants while you wait for the FAFSA to open.

Government Grants

If you are a need-based aid candidate, students may be eligible for free money from the government. For example, these programs can include Pell Grants and programs for teachers. These grants aren’t available to everyone, but if you can take advantage of this free money, great!

The good news is that if you fill out your FAFSA every year, the university should facilitate getting you the funds you deserve when you receive your financial aid package. However, numerous times, we have found that students had to ask the financial aid office about the TEACH Grant. So don’t assume anything!

College Gift Aid – Grants and Scholarships

Need-based

Did you know that the most free money comes from the colleges themselves? Yes, it’s true! Colleges award “free money” in two ways–based on need and based on merit. How much money you need is determined by this formula:

Cost of Attendance (COA) – Expected Family Contribution (EFC) = Demonstrated Financial Need

If a school costs $30,000 to attend and your family’s EFC is $10,000, your Demonstrated Financial Need is $20,000.

Not every school will make up that missing $20,000. However, some do. According to recent studies, close to 20 schools met 100% of a family’s demonstrated need. (Note: a family still must pay their EFC.) Other colleges will meet a portion of that demonstrated need.

Those 20 colleges and universities are some of the hardest academically to get into. Still, if your student can be accepted and you financially qualify, you will receive some great free money. If you are a need-based aid candidate, you should seek out schools that meet at or near 100% of your demonstrated financial need.

Merit-based scholarships

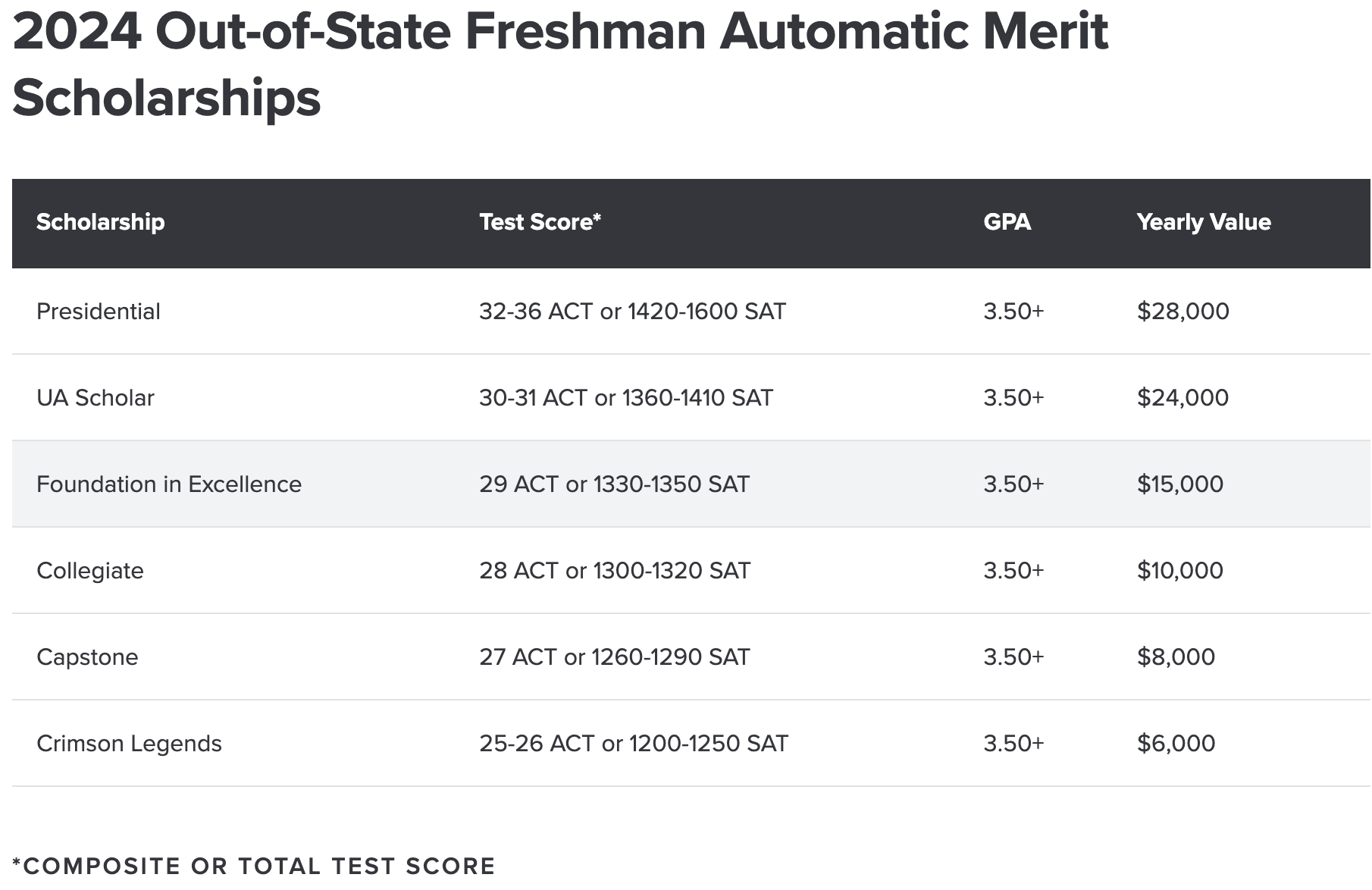

Colleges also award free money through scholarships based on merit to talented students. Some merit scholarships are automatic, and some are competitive. Some colleges, like the University of Alabama, will award set amounts of free money to every incoming student with a certain GPA and ACT score. Other schools like The Ohio State University will award scholarships based on talent but only to a select group determined competitively.

This free money is awarded without regard to financial need, so those families whose earnings are too high for need-based aid want to search out those colleges with a high percentage of merit awards to students like theirs.

Some numbers

When schools determine who is eligible for merit aid, they often look at the top 25% of their incoming class as the eligible students. They want to attract the most talented students. Colleges like the University of Alabama award $6,000 per year for four years in merit money to incoming out-of-state students with an ACT score of 25-26 and a GPA of 3.5+. They tier their awards so higher scores and grades receive more free money.

Knowing the deadlines, the qualifications, and having a target for test scores for admissions and scholarships is critical. Take a look below. Improving your score by just one point from a 28 to a 29 could mean an additional $5,000 per year!

A target

If you are applying to a college that awards free money scholarships competitively, you’ll want to be in their top 25% to have the best shot of receiving an award. It is not guaranteed, but your chances are better. Collegedata.com can help you determine the top 25% mark for test scores.

Be aware that many competitive scholarships are awarded not only for academics and test scores but the students’ full body of work that is desirable to the institution. Things like leadership and volunteerism are extremely important to the fabric of a university, and the schools want and need those types of students just as much as the high academic achievers.

Private Scholarships

Another source of free money is from private entities through scholarships from sources like a parent’s employer or local community groups. You can also look at scholarships from associations in the major and career you are working towards. For example, the local Financial Planning Association I am a member of has an annual scholarship of $1,000 for someone in a financial planning-related study area!

Also, remember your number one resource for community scholarships is your high school’s guidance office. In our “Scholarship Mythbusters” blog, we ask if you could earn $50 per hour, wouldn’t you?! Yes, finding private scholarships takes work and effort, but the rewards can add up.

For national searches, the College Board hosts one of the largest databases, and they won’t spam you with a bunch of advertisements. For those in Ohio, check out the Columbus Foundation for scholarship opportunities!

Private scholarship challenges

If someone “promises” they can find you scholarship money, RUN! The old cliché “If it sounds too good to be true, it probably is” applies here. You do not need to pay someone to search for scholarships in the age of the Internet.

In my experience, the hardest part about searching for private scholarships is motivating a high school senior who just submitted ten college applications and essays to do MORE applications and essays. But it can pay off big.

I would recommend applying to 6 to 10 scholarships that match your profile. Deadlines are often as early as December, and some are open for applications through April of the student’s senior year.

Keep your expectations realistic and understand that over 80% of the scholarships awarded are from colleges and universities.

Something you may not know…

If you are a need-based candidate, your private scholarships can impact the financial aid you receive from your college. Private scholarships will reduce your need-based aid from the institution. Sometimes, the gift aid or grant amount is reduced by the amount of the private scholarship, and sometimes, the school will reduce your work-study and/or need-based federal loans. This practice is called scholarship displacement. It depends on the school. Reducing your loan amount is ideal because you are replacing free money with money you would need to pay back!

Report all private scholarships to your financial aid office to avoid having to pay the money back to the institution later. You can read more about scholarship displacement here.

What to take away from all this?

Being an informed consumer of higher education means understanding how to make college affordable for your family.

- Will you qualify for need-based aid?

- What schools meet that need?

- How does your student compare academically to others for a particular college to win free scholarship money?

- And how do all these pieces of your personal puzzle fit together?

The college search process must be focused on creating the best possible outcomes for students and families. This means graduating on time (4 years) with manageable student loan debt without robbing your retirement.

Updated 11/2023

Originally published 12/2016

RELATED ARTICLES

College Planning

High School Course Options: What Are the Choices and Can They Save Money on College?

April 25, 2024